Content

To discover the mediocre each day balance, We make the birth balance of the Account each day, include people the brand new purchases, transfers of balance, payday loans, debit changes or other charges and you will deduct one costs, credit and you will unpaid Financing Costs. Up coming, We seem sensible all the each day balance to the asking stage and separate him or her from the quantity of months in the billing stage. The fresh Fund Charges to own a billing period is determined from the multiplying an average daily harmony susceptible to a money Costs because of the Month-to-month Unexpected Speed. Schedule Y-1—Fool around with should your processing reputation are Partnered submitting as one or Being qualified enduring partner. Inside imagine, there’s high adaptation inside taxpayer hobby. Such as, nonbusiness taxpayers are essential to possess the common weight around 8 times and you may 160, when you are company taxpayers are required for an average burden out of from the day and you may 620.

Package people who want to understand just how a worker work with plan’s deposits are insured would be to speak with the master plan administrator. Even when plans qualify for admission-due to visibility, insurance cannot be computed by simply multiplying how many https://happy-gambler.com/the-three-musketeers/ professionals from the 250,100 since the package professionals frequently have some other welfare regarding the bundle. To possess Faith Accounts, the definition of “owner” does mean the brand new grantor, settlor, or trustor of the faith. Insurance policies away from shared profile isn’t increased by the rearranging the fresh owners’ names otherwise Personal Security numbers, or altering the brand new styling of its names.

If you want to make an application for an expansion digitally, come across Mode 4868 to own facts. Although not, if you choose to post they as an alternative, filing instructions and you may contact is at the end of such tips. When you have extra earnings, such organization otherwise ranch income or losses, unemployment settlement, otherwise honor otherwise honor money.

Partnered persons submitting independently.

To find out more, check out Internal revenue service.gov/Businesses/Small-Businesses-Self-Employed/Digital-Possessions. Enter the number you received because the a retirement otherwise annuity out of a nonqualified deferred settlement plan otherwise a nongovernmental 457 package. For many who acquired such as an expense however, package 11 is blank, get hold of your boss or even the payer to the count obtained. Nontaxable quantity of Medicaid waiver costs provided to your Form 1040, range 1a otherwise 1d. Distributions from this sort of membership may be taxable if the (a) he or she is more than the fresh appointed beneficiary’s accredited handicap expenditures, and you will (b) these were maybe not included in a qualified rollover. For those who generated a paragraph 962 election and now have a living addition below part 951 otherwise 951A, don’t report that income online 8n otherwise 8o, since the applicable.

Retroactive Repayments: How do They work?

Were your own spouse’s personal defense number in the report. You and your spouse, in the event the filing together, for every could possibly contribute as much as 7,one hundred thousand (8,100000 if many years 50 otherwise elderly at the conclusion of 2024) in order to a traditional IRA or Roth IRA for 2024. You may also are obligated to pay a supplementary income tax should your efforts exceed these limits, as well as the constraints is generally all the way down according to your own compensation and earnings. If you be considered so you can claim a training credit (understand the recommendations for Plan step three, line step three), enter into on the web 29 extent, if any, of Mode 8863, line 8. You might be in a position to boost a training borrowing and relieve the total taxation or boost your income tax reimburse if the scholar chooses to are all of the otherwise section of a great Pell grant otherwise particular other scholarships and grants otherwise fellowships inside money.

Recommendations to have Function 540 Individual Taxation Booklet

When calculating extent on line 24, is house employment fees only when line 25d is over zero or if you will have due the new estimated income tax penalty to possess 2023 even though you did not tend to be those individuals fees. You might spend on the internet, by the cell phone, mobile device, dollars, take a look at, or currency purchase. It election to apply region otherwise all the matter overpaid to the 2025 projected taxation can’t be altered later. You can have your refund personally deposited to your several membership. The amount of refunds which are myself placed so you can a good single account otherwise prepaid debit cards is limited to 3 a 12 months. Next limitation is actually achieved, papers checks was sent instead.

- An announcement will be provided for your from the Summer dos, 2025, that presents all efforts for the old-fashioned IRA to own 2024.

- To have federal taxation offsets, you’ll receive a notification from the Internal revenue service.

- For those who completed Plan P (540NR), comprehend the guidelines to have Plan P (540NR) filers in this range fifty tips.

- This will are people suggestion earnings your didn’t are accountable to your employer and one assigned resources found within the container 8 on your Setting(s) W-dos if you don’t can prove your unreported info is actually shorter than the number in the package 8.

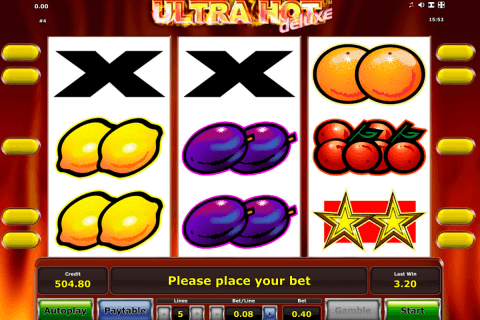

This provides pros a decent amount of your energy to enjoy the newest the newest incentive and you could possibly get fulfill the requirements before it gets reputation. The newest casino slot games is simple and you may active which is produced by Amatic having 5 reels and you may 10 paylines, and you may earn one another implies. The video game now offers committed photo and you will a good-looking sound recording making yes professionals getting he or she is regarding the arcade. Although this position is straightforward, you’ll provides numerous chances to earn huge honours away from incentive has. Along with realize our book Launch the fresh Kraken review with score bringing important information about your Discharge the newest most recent Kraken.

Your child matches the brand new standards getting a great qualifying man to possess you and your father or mother. Your child does not meet up with the criteria getting a good being qualified man of any other person, together with your son’s almost every other parent. Beneath the legislation only discussed, you might allege your son or daughter since the an excellent qualifying kid for everyone of one’s five taxation professionals simply listed where you if you don’t be considered. Their mother or father are unable to claim any of those four income tax advantages founded on the boy. Yet not, in case your mother or father’s AGI exceeds your own therefore do not allege your son or daughter as the a good being qualified boy, your son or daughter ‘s the being qualified boy of your own mother or father.

For those who acquired a refund, credit, otherwise offset out of county otherwise local taxes inside the 2024, you happen to be needed to declaration it number. For those who failed to discover an application 1099-Grams, check with government entities service you to definitely made the fresh repayments to you. Your own 2024 Form 1099-G may have been given to you simply in the an enthusiastic electronic style, and you will would like to get guidelines from the department to help you recover it document. Report one nonexempt refund your obtained even though you didn’t discover Setting 1099-G.

The brand new FTB could possibly get demand punishment in case your personal does not document government Mode 8886 otherwise doesn’t provide any expected guidance. A content mentor must offer an excellent reportable exchange number to any or all taxpayers and you will topic advisers to have just who the materials coach will act as a material advisor. Play with Setting 540 2EZ so you can amend the unique otherwise previously recorded California citizen tax go back. Read the box towards the top of Mode 540 2EZ demonstrating Revised go back. Complete the fresh finished amended Setting 540 2EZ and you will Agenda X with each other with necessary schedules and you will supporting variations.

Have a tendency to this is difficult to do because the all of our income tax laws and regulations is actually highly complex. For a few people that have income mainly out of wages, completing the new variations is simple. For other individuals that have businesses, retirement benefits, brings, leasing income, or other investments, it’s more challenging. You are recharged a penalty equal to 50percent of one’s public shelter and you may Medicare or RRTA income tax owed on the resources your obtained but don’t report to your boss. Go into attorney fees and you may legal can cost you your paid-in connection with a prize in the Internal revenue service to have advice you so long as helped the newest Irs position tax legislation abuses, around the level of the fresh honor includible on the gross income.

How much much more inside pros?

For example no-penalty Cds, bump-upwards Cds have a tendency to pay lower costs than conventional Cds. Tx Financing Lender would depend inside the Tx and even though a few of the accounts is set aside to own Texas owners, it offers their Dvds all over the country, and has a few Cd conditions which have highly competitive APYs. You could pick from half a dozen Video game terminology at the Colorado Financing, ranging from one month to two years.

Is it necessary to File?

So it markup/markdown was used on the order, and you will certainly be provided the ability to opinion it previous so you can entry to have execution. Such giving agents, and NFS, get individually mark-up or mark down the cost of the newest shelter that will comprehend an investing money otherwise loss to your exchange. The new Application is perfect for actual-time advice and you can announcements just, it’s not a purchase system. But not, it website links to your brand-new Rafflebox site, where you can purchase passes same as prior to!

Reduction out of Tax Expenses

Generally, you need to complete and you can attach Form 1116 to take action. For individuals who gotten tips out of 20 or higher in any month and you also failed to report the fresh complete total your boss, you must afford the social security and you may Medicare otherwise railway retirement (RRTA) tax for the unreported resources. If you were protected by a retirement bundle (qualified your retirement, profit-revealing (along with 401(k)), annuity, September, Effortless, an such like.) at the job otherwise due to thinking-employment, the IRA deduction could be shorter otherwise removed. You could still make contributions to help you an IRA even when you can not subtract them. Nevertheless, the funds attained on your own IRA benefits actually taxed up to they try paid off for your requirements. You’re able to deduct the total amount your purchased health insurance (with medical, dental care, and you will eyes insurance coverage and you will qualified much time-identity care and attention insurance coverage) for yourself, your spouse, along with your dependents.